SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Baum, Smith & Clemens, LLP

CERTIFIED PUBLIC ACCOUNTANTS AND BUSINESS ADVISORS

2060 Detwiler Road, Suite 125, Harleysville, PA 19438

Phone: 215-368-5755

Fax: 215-368-7038

Email: info@bsccpas.com

Website: www.bsccpas.com

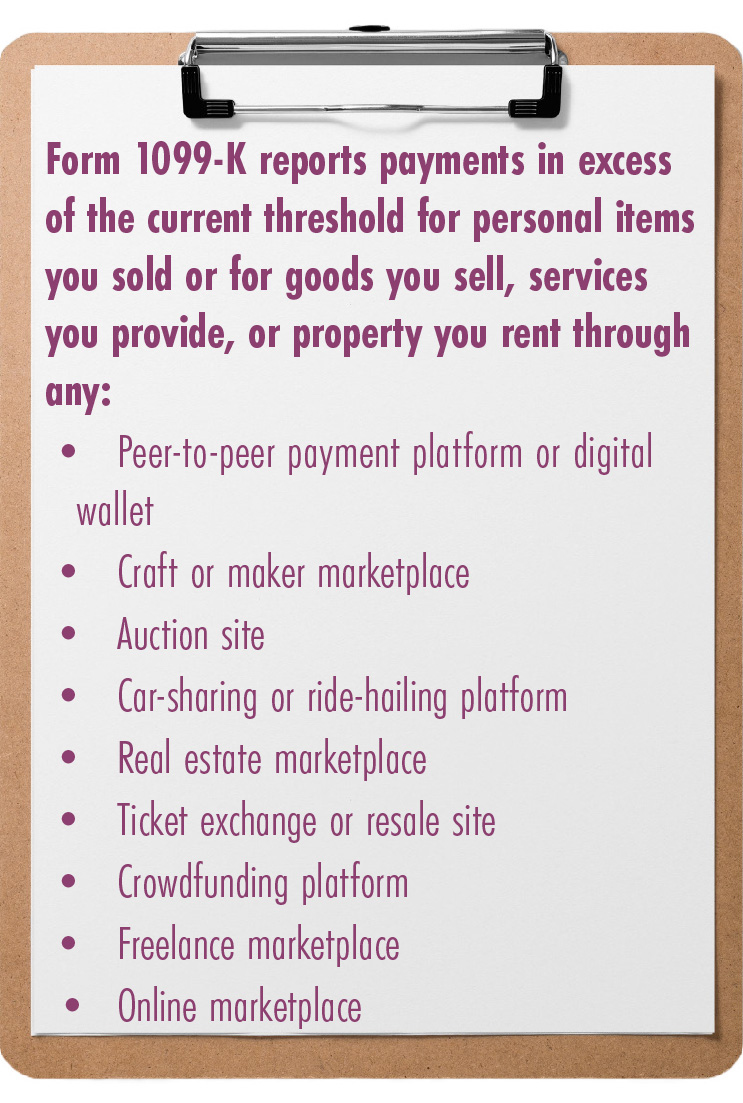

In an unexpected move, the IRS has postponed enforcement of a 2021 American Rescue Plan provision affecting self-employed people who earn money on third-party platforms like eBay, AirBnB, Etsy, VRBO or have payments processed by services like Venmo and PayPal. The provision would have required these platforms to report gross payments of $600 or more to you and the IRS in 2023.

Now, for 2023 tax filing, the previous reporting threshold of more than 200 transactions per year exceeding an aggregate amount of $20,000 remains in effect. The provision does not change what counts as income or how tax is calculated—just what the online platforms have to report to the IRS. You must still track and report your online sales and services income. Your tax professional can tell you more.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.