SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

John A. Knutson & Co., PLLP

Certified Public Accountants

1781 Prior Avenue North, Falcon Heights, MN 55113

Website: www.jakcpa.com

Unfortunately, some parents believe that if they died prematurely guardians for their child(ren) would automatically be the Godparents. This may be their wishes, but unless they properly draft legal documents, the court will decide what happens to the children—and your assets.

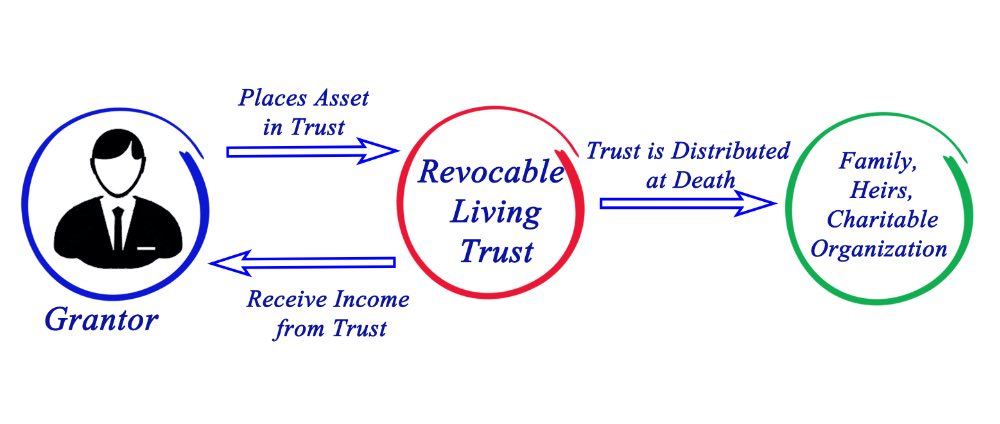

A popular choice is a revocable living trust. Benefits of a revocable living trust are that you can change it as often as you like because it remains your personal property until you die.

Planning for a disabled child is a bit more complicated. A good option in this situation is a special needs trust, which can help ensure the care and oversight needed indefinitely.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.