CONTACT US

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Noel Santos

Emmanuel A. Santos JD CPA, Incorporated

447 Sutter Street, Suite 714, San Francisco, CA 94108

Phone: 415-362-8921

Fax: 415-362-8924

Cell: 415-412-5839

Email: noel@eas-cpa.com

Website: www.eas-cpa.com

Your Business...Your Family...Our Concern

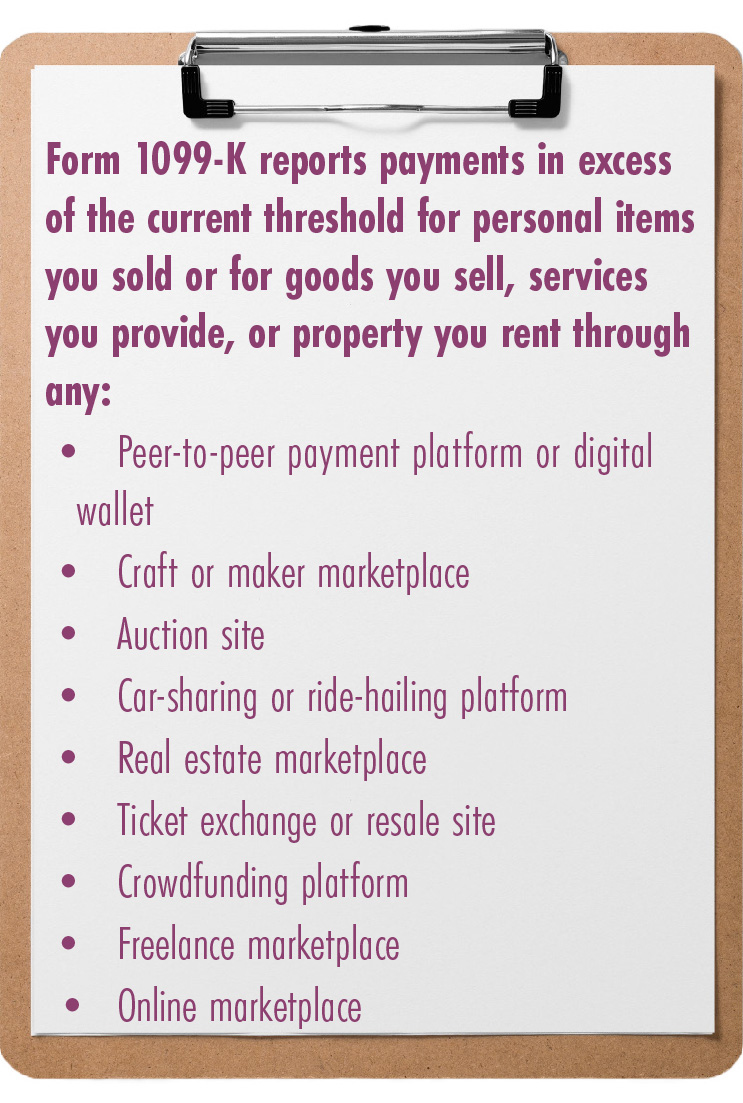

In an unexpected move, the IRS has postponed enforcement of a 2021 American Rescue Plan provision affecting self-employed people who earn money on third-party platforms like eBay, AirBnB, Etsy, VRBO or have payments processed by services like Venmo and PayPal. The provision would have required these platforms to report gross payments of $600 or more to you and the IRS in 2023.

Now, for 2023 tax filing, the previous reporting threshold of more than 200 transactions per year exceeding an aggregate amount of $20,000 remains in effect. The provision does not change what counts as income or how tax is calculated—just what the online platforms have to report to the IRS. You must still track and report your online sales and services income. Your tax professional can tell you more.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.