CONTACT US

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Noel Santos

Emmanuel A. Santos JD CPA, Incorporated

447 Sutter Street, Suite 714, San Francisco, CA 94108

Phone: 415-362-8921

Fax: 415-362-8924

Cell: 415-412-5839

Email: noel@eas-cpa.com

Website: www.eas-cpa.com

Your Business...Your Family...Our Concern

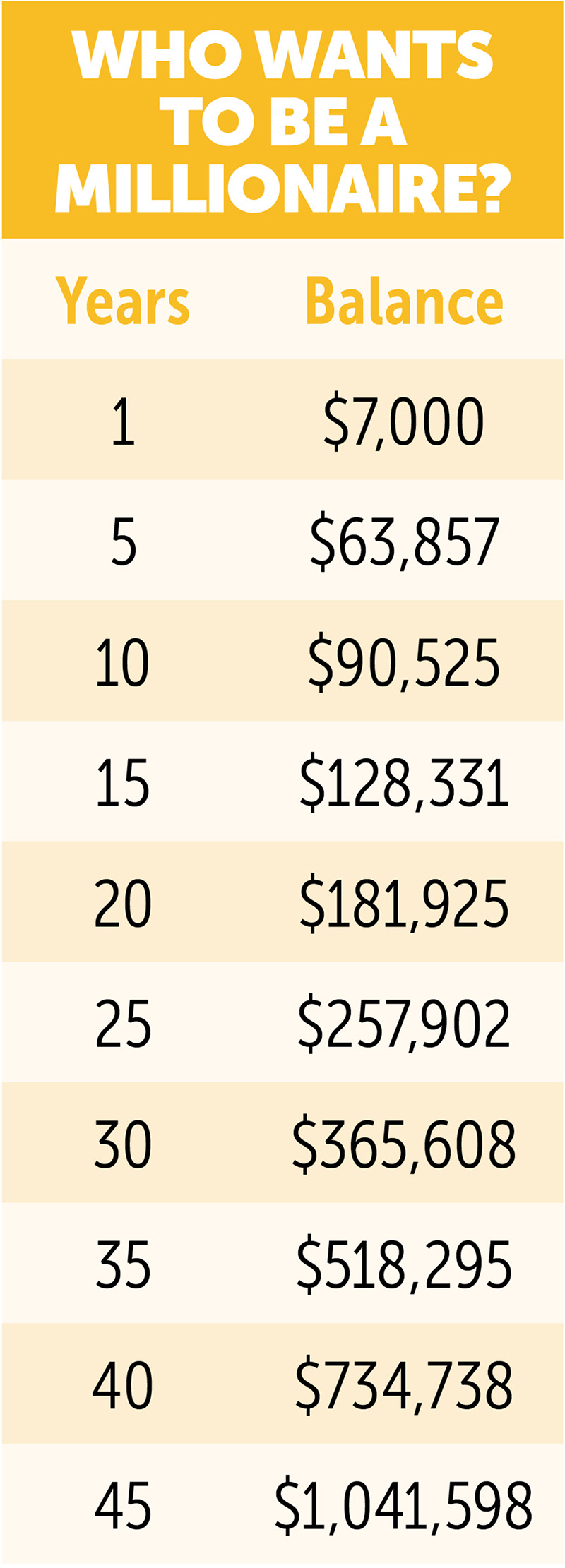

You may be able to do this utilizing any unused funds in the student’s 529 Plan. The IRS now allows rollovers of these funds to a Roth IRA in the child’s name.

The lifetime 529 rollover limit is $35,000, so you’d have to do a rollover annually for several years. As the owner of the Roth IRA, your graduate must have earned income at least equal to the amount of the annual rollover.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.