SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

"In Memoriam of our Founder, our Patriarch, and my Partner...

Rest in peace, Dad"

Palestra Financial

1904 Duck Slough Blvd., Trinity, FL 34655

Phone: 844-WHY-PLAN™

Website: www.PalestraFinancial.com

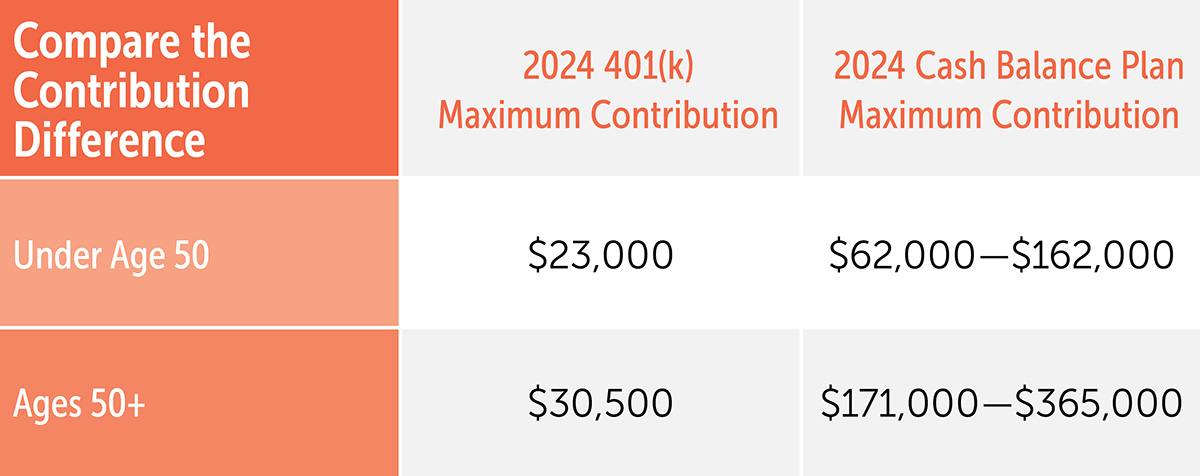

Need to boost your retirement savings? A cash balance plan — generally along with a 401(k) plan — might allow you to compensate for years of underfunding your retirement.

Blending features of a traditional pension plan with the look and feel of a 401(k)/profit-sharing plan, these hybrid plans require company contributions based on a percentage of pay or a flat dollar amount. An annual interest credit set in the plan documents is credited to each participant’s balance. You must ensure contributions to your plan are invested to pursue the plan’s rate goal. When a participant terminates employment, vested account balances can be withdrawn, which may trigger taxes, or rolled over to an IRA or other employer retirement plan.

For those nearing retirement, cash balance plans, unlike traditional pension plans, have accelerated vesting requirements. Participants must be 100% vested in their benefits no later than after completing three years of vesting service. No graded vesting schedule is allowed. The Pension Benefit Guaranty Corp (PBGC) protects most benefits under a cash balance plan.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.