SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

8620 North New Braunfels Suite 300, San Antonio, TX 78217

Phone: 210-340-8351

Fax: 210-340-8359

Website: theKFORDgroup.com

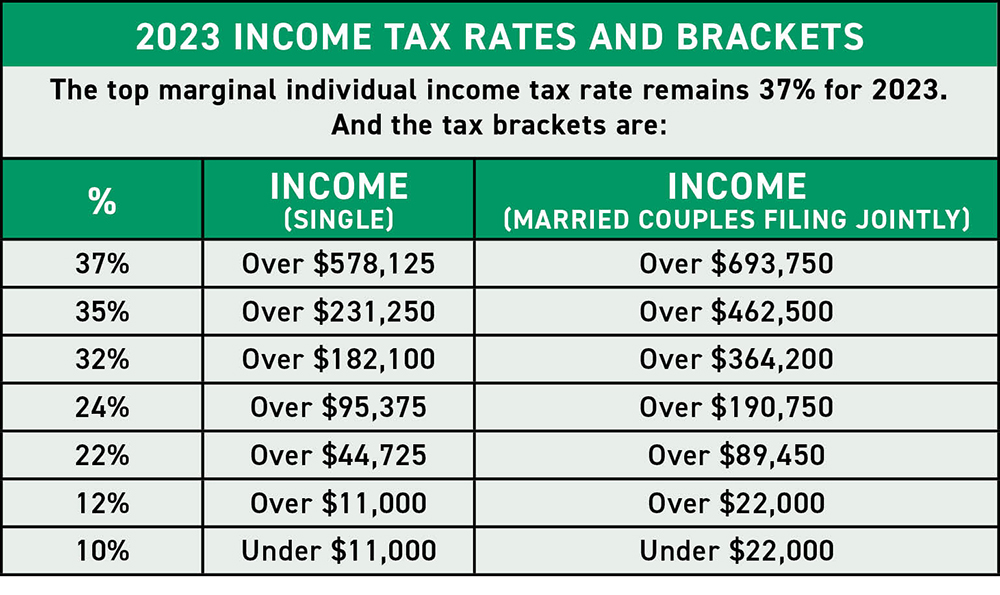

The IRS made sizable adjustments to several tax limits in response to the high inflation levels from 2022. Taxpayers will see increases in tax brackets, the standard deduction, and the gift tax exclusion for 2023.

The limit on annual contributions to an IRA increased to $6,500, up from $6,000. The IRA catch-up contribution limit remains $1,000.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.