SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Nolan Accounting Center

4262 South 108th Street

Greenfield, WI 53228

Phone: 414-425-5690

Fax: 414-425-2373

Website: www.nolanaccounting.com

Bonus depreciation is a valuable tax-saving tool for businesses. It allows your business to take an immediate first-year deduction on the purchase of eligible business property.

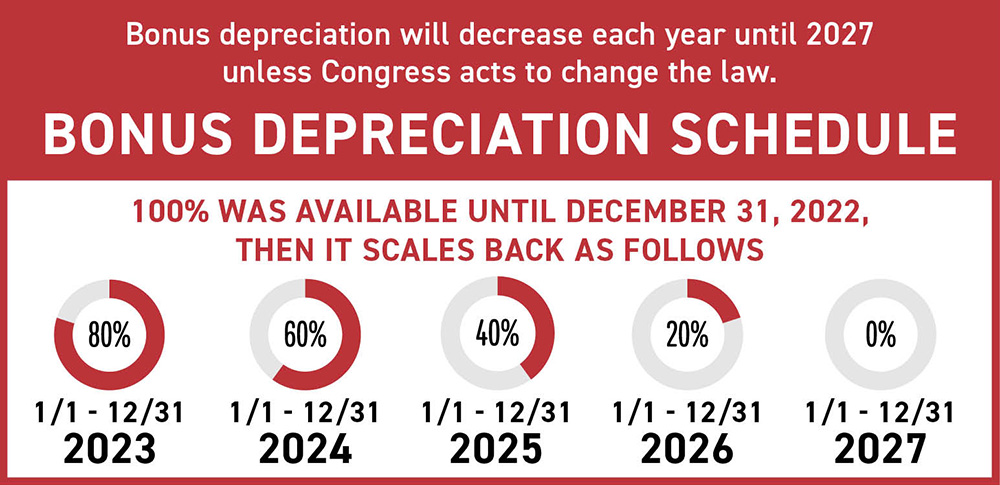

Before 2023, you could deduct 100% of the cost. Now, 80% is deductible in the first year. The remaining 20% gets deducted over the asset’s life.

This special deduction allowance is an additional deduction you can take after you take the Section 179 deduction and before you figure regular depreciation for the year.

Only certain types of property may be eligible for bonus depreciation. The item must be:

Also, if you choose bonus depreciation for one of your company vehicles, you’ll need to claim it for all your vehicles. Unlike Section 179 depreciation, you cannot be selective.

Beware that bonus depreciation will phase out to zero effective January 1, 2027. (See the graphic above).

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.