SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Nolan Accounting Center

4262 South 108th Street

Greenfield, WI 53228

Phone: 414-425-5690

Fax: 414-425-2373

Website: www.nolanaccounting.com

The 2025 Social Security Board of Trustees Report projects the maximum wage subject to Social Security taxes will rise to $184,500 in 2026, up $8,400 from 2025's $176,100 cap. Employees and employers each contribute 6.2% (totaling 12.4%) to Social Security, while employees also pay a 1.45% Medicare tax, with an additional 0.9% tax applied to wages exceeding $200,000. Self-employed individuals cover the full 12.4% Social Security tax.

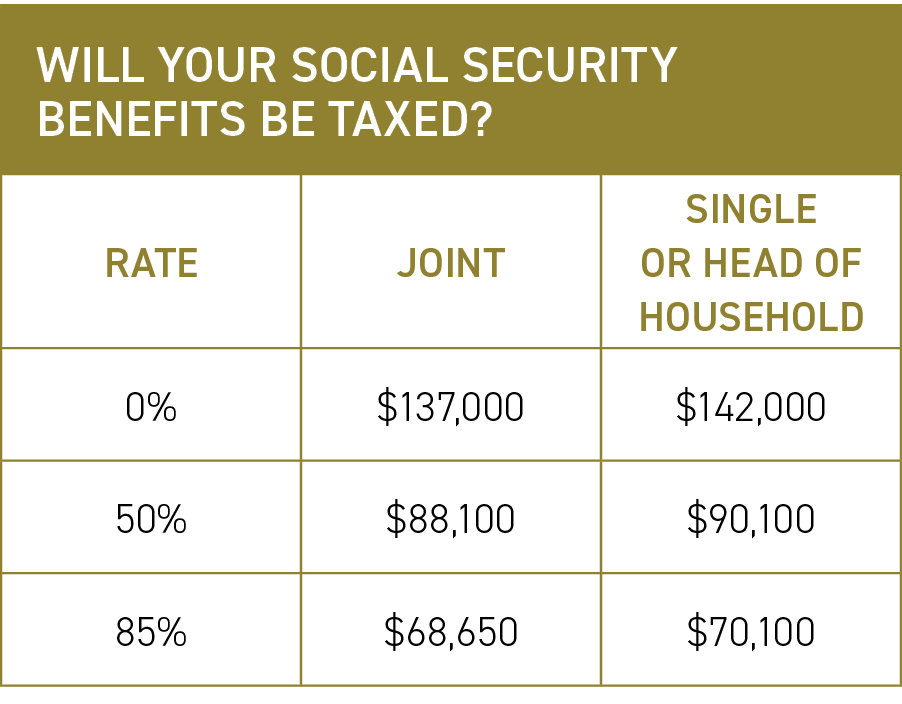

Retirees may face taxes on up to 85% of their Social Security benefits, depending on their provisional income. This includes other taxable income, tax-exempt interest, and half of their Social Security benefit.

To estimate your 2026 tax liability, review your income sources, consult the IRS guidelines, and talk to your tax advisor. Stay informed to plan effectively for your financial future.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.